While in contract negotiation, the payment method and payment terms must be specified and agreed upon. There are various factors that will influence the methods of payment and payment terms, including:

- Location of the importer

- The supplier

- Previous business relationships of the two parties

Mutual assessment of the risks involved in the transaction will influence the method of payment and payment terms. The importer runs the risk of paying for goods that are not received, or that are not received as ordered, and the exporter risks shipping goods but not receiving payment.

To be effective, the agreement must balance these risks and satisfy both sides so that the deal is worth undertaking. When and how payment must be made for goods and/or services is a matter of negotiation, and are part of the terms and conditions of the contract.

The purchasing company will normally want to defer payment and secure the longest possible time between the date when products are received and the date funds are transferred. During this time, the importer can verify the quality of the shipment, evaluate product performance and minimize the risk of fraud. The importer might even wish to save on financing costs by selling the goods before paying for them.

On the other hand, the exporter will want to be paid as quickly as possible, even to the extent of receiving payment before shipping the ordered goods. As the payment objectives of the importer and exporter pull in opposite directions, the payment terms agreed upon in a contract often reflect the relative strengths of the two parties.

What are my options for payment methods?

There are different methods of arranging payment that are available to an exporter. These include:

- Cash in advance or prepayment

- Documentary letter of credit

- Documentary collection

- Open account

In addition, consignment—while not a payment method—is another way of structuring a transaction between the importer and exporter. In a consignment deal, the exporter retains the title to—or ownership of—a shipment of goods, using the importer as an agent to sell those goods. The importer then remits the proceeds after selling the goods to a foreign customer. If the goods are not sold, the agent will return them to the exporter.

With respect to services, when there are no goods to serve as collateral, often only the simplest payment terms are used, such as open account and cash in advance or prepayment. Therefore, service providers tend to break their work into smaller tasks/objectives with more frequent payments to minimize the exposure associated with non-payment. In some instances, service providers could insist on a letter of credit for payment provided that the importer and exporter can agree on documentary evidence from the work performed that would suffice for the release of payment.

Want to learn more about all aspects of how to manage business costs and cash flows, ensure payment and stay profitable long-term? Get started with the FITTskills International Trade Finance online course!

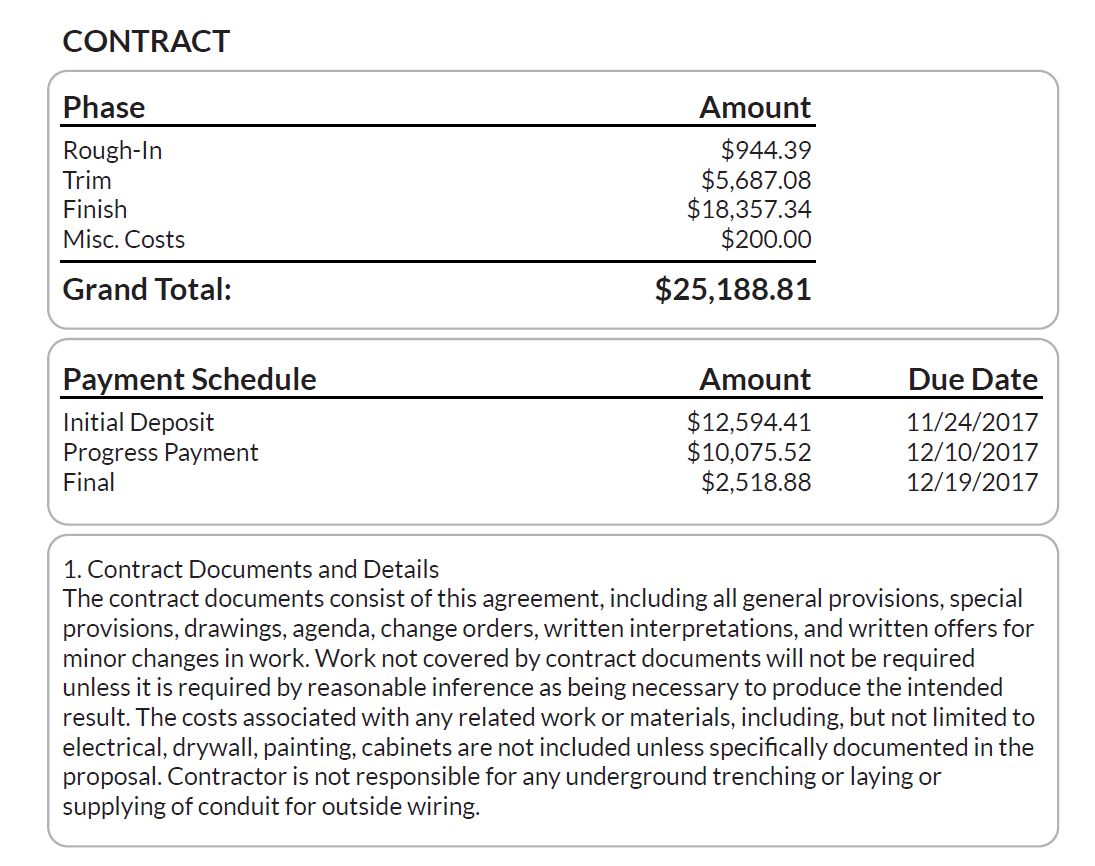

Developing your schedule of payments

When an exporter and importer are negotiating a contract that is spread over a period of time, parties tend to outline a schedule of payments that defines the dates at which payments are made from the importer to the exporter. When contract duration is long (e.g. 12 months or more), a schedule of payment is based on various milestones that will be reached during the contract.

Milestone-based contracts are much easier to control and payments are based on achieved results. The success of such contracts lies in the wisdom of defining the milestones, which should be justified to both client as well as contractor. In this way, the percentage of the contract that has been completed can be evaluated and the payment that is due can be assessed. In addition, scheduled payments can either be parameterised or customized.

What is a parameterised schedule?

A parameterised schedule is generated based on a set of rules and market conventions to define the frequencies of the payments. These parameters include:

- Payment frequency: Annually, semi-annually, quarterly, monthly, weekly, daily, continuous

- Payment day: The day of the month on which the payment is made

- Date rolling: The rule used to adjust the payment date if the schedule date is not a business day

- Start date: The date of the first payment

- End date: The date of the last payment, also known as the maturity date

What is a customized schedule?

A customized schedule consists of a series of dates that define exactly when payments will be made and is tailored to the expected progress of the contract over its duration.

The following image shows a sample of a schedule of payment.

disqus comments