The facts say it all. Four of the ten fastest growing economies in the world are in Africa. By 2050, Africa will account for 20-25% of the world’s population, more than China or India. And each country in the region has made it easier to do business through a host of regulatory reforms.

The facts say it all. Four of the ten fastest growing economies in the world are in Africa. By 2050, Africa will account for 20-25% of the world’s population, more than China or India. And each country in the region has made it easier to do business through a host of regulatory reforms.

It’s true, Africa is ripe with opportunities, but they go largely untapped by North American firms, which have been hesitant to enter markets where their European and Asian competitors are already doing business – and profiting from it.

The World Bank estimates that real GDP in Sub-Saharan Africa (SSA) will grow by 4.5%, whereas the U.S. economy is forecast to grow 2.7% this year, and the Euro area is expected to expand at around 1.5%.

Granted, it is easier for developing countries to deliver larger growth rates, since they’re starting from a lower economic base, but SSA is simultaneously experiencing:

- rapid economic growth,

- unprecedented political stability,

- regulatory and legal reforms; and

- a rising middle-class population.

All of these factors are leading to greater levels of transparency and accountability. And investors are taking notice.

In 2013, the OECD reported that foreign direct investment (FDI) into SSA increased by 4.7%. Private equity firms are scanning the continent for opportunities. In fact, Helios Investment Partners, a London-based firm, boasts the first ever billion dollar fund for Africa.

Yet only 1% of global private equity goes to SSA and .3% of the average investment portfolio in the United States – that’s just $3 out of every $1,000 – is invested in Africa.

In terms of trade, the potential for growth is enormous. In particular, Africa offers tremendous opportunities for companies that provide goods or services related to consumer products, infrastructure development and public services.

Meet the growing demand for consumer products

Historically, investors have focused on the extraction industries in Africa, so economies rich in natural resources (Angola, Nigeria and Mozambique) received the bulk of FDI.

However, there has been a shift away from extractive industries towards consumer-related sectors as demand and purchasing power increase alongside a growing middle-class.

As a matter of fact, in 2014, mining and minerals exited the top 10 sectors for investment in SSA.

The top three – technology, retail and financial services – demonstrate the changing nature of investment in Africa.

Consumer demand for new products and services across a wide range of sectors is the leading cause of economic diversification. Rising demand for products – from laundry detergent to champagne to mobile phones – presents significant opportunities for manufacturers of consumer goods.

Look at Kenya, where nearly three quarters of the population own cell phones, and almost 60% of Kenyans use cell phones for mobile payment and banking, making it the mobile-payment capital of the world.

Look to partners for the best opportunities in infrastructure development

The World Bank estimates that SSA needs $90 billion in infrastructure investment alone. That’s not $90 billion to add or repair things either; it’s the amount needed to build greenfield projects each year.

Infrastructure is critical to the effective functioning of an economy, from ports that bring cargo in and out to electricity grids that power manufacturing, and financial markets that keep the entire system moving.

African markets are investing heavily in capital improvement projects to meet the forecasted growth in electricity demand, water supply, transportation networks, and telecommunications services.

Many of these projects are funded by multilateral development institutions such as the World Bank, United Nations, and African Development Bank, as well as the U.S. Agency for International Development, U.S. Trade and Development Agency and the Canadian Department of Foreign Affairs, Trade and Development.

Tenders are posted on their websites, so firms can directly respond to opportunities to support the development of infrastructure projects throughout Africa.

International trade can involve public services too

There is also a huge need for public services, particularly healthcare and education, throughout Africa.

With its high population growth, SSA is much more open to private investment in these areas, whereas most industrialized economies consider them to be public goods that should be provided by the state, and tend to be suspicious of private sector involvement in them.

According to a recent report by the International Finance Corporation (the private sector arm of the World Bank Group), spending on health in SSA is expected to double over the next 10 years.

Investments of $25-30 billion will be needed to meet the demand, with the private sector playing a key role.

Interestingly, companies and investors that are already in Africa have a much more favorable view of the opportunities there and the ease of doing business, while firms that aren’t there are far more skeptical.

To build your business in Africa, there are three things to consider.

1. Think global, act local

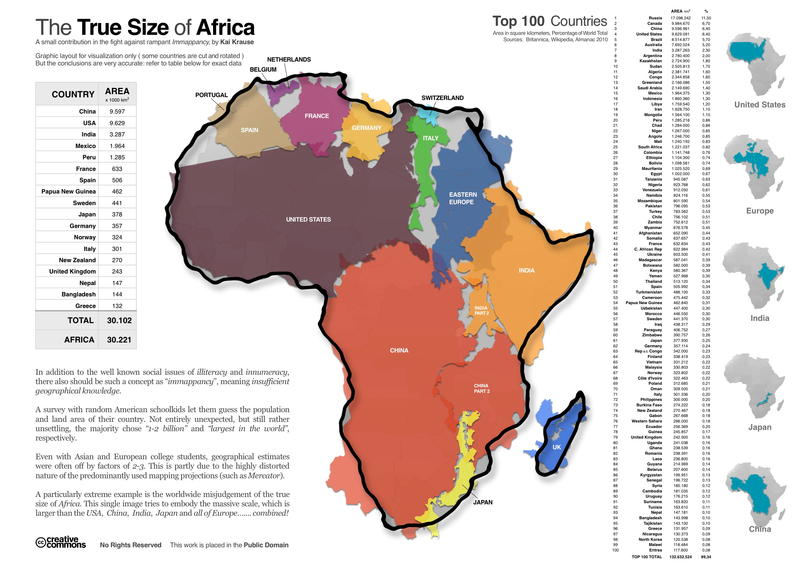

Africa is big. However, Africa is not a single, monolithic place. It’s composed of 54 different countries (48 below the Sahara) that have their own unique economies, governments, cultures and every other independent system you would expect a sovereign nation to have.

Africa is big. However, Africa is not a single, monolithic place. It’s composed of 54 different countries (48 below the Sahara) that have their own unique economies, governments, cultures and every other independent system you would expect a sovereign nation to have.

They are also distinct from a geographic and economic perspective, so each county requires an independent approach.

To be successful in SSA, you have to know your Mali from Malawi and Mauritania from Mauritius.

You need to explore each individual market and develop an appropriate strategy. That requires a local presence.

Although distributors and agents can help you enter a market, developing a sustainable strategy requires feet on the ground in your priority countries.

Companies with representatives in country can gather local market intelligence, cultivate and maintain key relationships with government officials, oversee distributors and agents and quickly respond to changing market dynamics.

2. Play the long game

Building business in Africa is not a short-term proposition. It is a long-term strategy based on relationship building, technology transfer, skills training and a demonstrated dedication to the markets where you want to work.

Having a local representative will help position you for success, but patience is key.

Despite the high-growth rates in the region, African economies are still small, so big returns and volumes are often not feasible at the beginning. Firms that are hoping to weather the slowdown in the EU and China by making quick returns in Africa will need to revise their expectations.

Additionally, navigating the complex regulatory and legal environments will take time and access to trusted advisors who can shepherd you through the process.

3. Manage risks

Like most emerging markets, SSA presents a complex operating environment that is prone to risks. Companies need to navigate volatility and develop appropriate mitigation strategies, but oftentimes, firms overprice the risk exposure in SSA and abandon operations altogether.

Companies need to thoughtfully evaluate situations to determine if a change in strategy is required, or if a short-term contingency plan will suffice, such as selling products on-line rather than in-store during security threats so customers can avoid public places.

Doing business in Africa isn’t going to be easy, but it will be rewarding if you dedicate the time and resources necessary to develop and implement a thoughtful approach.

But act fast! European and Asian firms are actively engaged in Africa – and thriving- so don’t be the last one to arrive at the party.

As they say, if you’re not at the table, you’re on the menu.

What steps does your business take to identify and take advantage of business opportunities in Africa?

disqus comments